By Emily Guy Birken

Uncover the reality approximately making plans for retirement!

From monetary advisors and pundits on tv to colleagues and relatives, every person has whatever to assert approximately retirement. yet how a lot of it really is real? no matter if you are looking to maneuver right into a senior dwelling neighborhood or shuttle the realm, Choose Your Retirement indicates you the way to realistically organize for the longer term you want. within, you will discover professional suggestion for selecting the easiest retirement direction for you and your loved ones in addition to info on universal myths like:

- You will basically want eighty percentage of your present source of revenue in retirement

- Medicare will hide your entire health-care needs

- Switching investments over to bonds is the most secure retirement option

- Social protection will run out in 2033, leaving hundreds of thousands with no their promised benefits

choked with 1000s of evidence approximately retiring, Choose Your Retirement is helping you place possible monetary objectives and plan for the retirement--and life--you've consistently wanted.

Preview of Choose Your Retirement: Find the Right Path to Your New Adventure PDF

Similar Self Help books

inGenius: A Crash Course on Creativity

Resourceful. cutting edge. creative. those phrases describe the visionaries all of us appreciate and recognize. they usually can describe you, too. opposite to universal trust, creativity isn't really a present a few of us are born with. it's a ability that each one folks can research. foreign bestselling writer and award-winning Stanford collage educator Tina Seelig has labored with a few of the enterprise world’s most sensible and brightest, who're now one of the decision-makers at businesses akin to Google, Genentech, IBM, and Cisco.

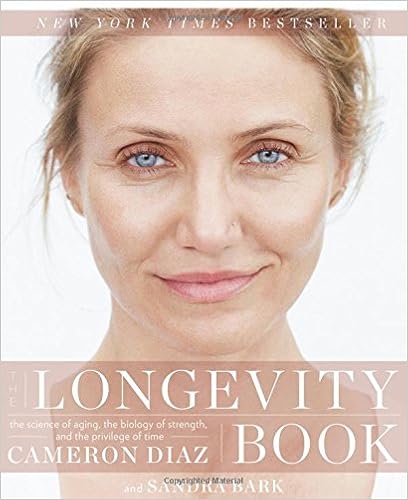

The Longevity Book: The Science of Aging, the Biology of Strength, and the Privilege of Time

Long island occasions bestsellerCameron Diaz follows up her no 1 manhattan occasions bestseller, The physique publication, with a private, useful, and authoritative consultant that examines the artwork and technology of getting old and provides concrete steps ladies can take to create plentiful health and wellbeing and resilience as they age. Cameron Diaz wrote The physique ebook to aid teach younger ladies approximately how their our bodies functionality, empowering them to make better-informed offerings approximately their healthiness and inspiring them to appear past the newest wellbeing and fitness developments to appreciate their our bodies on the mobile point.

The Little Book of Skin Care: Korean Beauty Secrets for Healthy, Glowing Skin

The secrets and techniques at the back of the world's most pretty epidermis! In Korea, fit, sparkling dermis is the fitting kind of attractiveness. it truly is thought of plausible by way of all, women and men, younger and old—and it starts off with adopting a skin-first mentality. Now, this Korean good looks philosophy has taken the realm via hurricane! because the founding father of Soko Glam, a number one Korean attractiveness and way of life web site, esthetician and wonder specialist Charlotte Cho publications you thru the world-renowned Korean ten-step skin-care routine—and some distance beyond—to assist you in attaining the clearest and so much radiant epidermis of your lifestyles With Charlotte's step by step tutorials, skin-care information, and recommendation on what to seem for in items in any respect cost degrees, you will how to pamper and deal with your epidermis at domestic with Korean-approved concepts and pull off the "no make-up" make-up glance we have seen and well-known on ladies within the streets of Seoul.

TV’s most up-to-date own finance celebrity indicates how you can increase the mind-set, self-discipline, and spirit to develop wealth by yourself terms—without worry or nervousness, Farnoosh Torabi combines behavioral psychology with genuine angle! construct a more healthy courting with money…map a plan according to what you care about…transform goals into reality.

Reviews

“ during this exceptional ‘journey within,’ and with splendor, wit, and urban specificity, Farnoosh Torabi is helping contributors specialise in the mental and behavioral components which are severe to monetary and funding good fortune. ”

--David M. Darst, CFA, leader funding Strategist, Morgan Stanley Smith Barney and writer of The Little e-book That Saves Your resources and The artwork of Asset Allocation

“Farnoosh quite will get it. Her insights are amazingly functional, considerate, and complex; a truly infrequent blend in terms of own finance specialists. Psych your self wealthy achieves a lofty objective: explaining a fancy challenge inside useful daily terms--without pulling any punches. Her recommendation is usually actionable, and her deep dedication to truly aiding children via tricky monetary difficulties comes throughout loud and transparent. i might like to see extra specialists persist with Farnoosh’s lead. ”

--Ian Cohen, CEO and President, credits. com

“As the concern shifts from the monetary to monetary to social sphere, empowerment and information are the best allies of the person investor. Farnoosh paints an enlightened course on our trip to higher tomorrows. ”

--Todd Harrison, FoTV’s latest own finance megastar indicates the way to improve the frame of mind, self-discipline, and spirit to develop wealth by yourself terms—without worry or anxiousness, Farnoosh Torabi combines behavioral psychology with genuine angle! construct a more fit courting with money…map a plan in response to what you care about…transform desires into fact.

- Notes from a Blue Bike: The Art of Living Intentionally in a Chaotic World

- Do Cool Sh*t: Quit Your Day Job, Start Your Own Business, and Live Happily Ever After

- You Can Sleep Well: Change Your Thinking, Change Your Life

- Habit Stacking: 97 Small Life Changes That Take Five Minutes or Less

- Rainy Brain, Sunny Brain: How to Retrain Your Brain to Overcome Pessimism and Achieve a More Positive Outlook

- The ABCs of Adulthood: An Alphabet of Life Lessons

Extra info for Choose Your Retirement: Find the Right Path to Your New Adventure

The charity invests the reward, and it turns into a part of the charity’s resources. The annuity is sponsored through everything of the charity’s resources (not simply the gift), this means that annuity funds are assured it doesn't matter what occurs to the invested present. on the time of your demise, the charity will get to maintain the principal—which may possibly in all probability nonetheless be intact counting on how the establishment has controlled its investments. in case you make the most of the sort of charitable giving plan, you not just get to anticipate an annuity check for all times, yet you furthermore mght get to contemplate the preliminary donation as a tax deduction within the yr that you simply make the reward, and at the very least a component of your annuity funds are handled as a partial tax-free go back of your gift—although you'll owe commonplace source of revenue tax at the remainder of each one annuity money. Charitable reward annuities are quite beautiful for traders who've taxable investments that liked unparalleled development. less than basic situations, for those who have been to promote these investments, the sale may set off the capital earnings tax, which more often than not will consume up 15 percentage of that progress (as of 2015). in spite of the fact that, via gifting the funding to a charity (which is tax exempt), the establishment is ready to benefit from the complete worth of the funding whenever you get to take pleasure in a assured source of revenue move for all times. additionally, you are going to keep away from either property and reward taxes at the estate used for the annuity. for additional info approximately charitable reward annuities and the charities that make the most of them, try out the yank Council on present Annuities (www. acga-web. org). CHARITABLE the rest belief just like the charitable reward annuity, a charitable the rest belief enables you to provide a present to a charity whereas delivering your self with assured source of revenue for all times. in spite of the fact that, this automobile is a belief you might want to manage with assistance from a monetary planner and/or an lawyer. To create this sort of belief, you present a lump sum (or an funding or different resources) to a belief, the last word beneficiary of that is your favourite charity. In impression, this transfers possession of the resources from you to the charity. The charity will obtain no matter what important is still within the belief on the time of your dying. for those who create the belief, you are going to verify the categorical phrases concerning how the cash should be invested and what sort of source of revenue could be paid out to you. There are different types of charitable the rest trusts: annuity trusts and unitrusts. Annuity trusts pay out a set quantity that you simply set on the time you place the belief in position, whereas unitrusts make common funds in response to a percent of the price of the belief. Unitrusts let you get pleasure from sessions of progress, yet you furthermore mght see your source of revenue pass down with marketplace downturns. furthermore, annuity trusts are “closed,” that means you can't upload any estate or resources to the sort of belief, whereas unitrusts let you upload extra resources at any time. As with a charitable reward annuity, utilizing any such belief can help to prevent paying capital profits taxes on liked resources, considering charities are tax exempt.