Center institution and highschool scholars spend more cash than ever nowadays, yet so much have little or no (if any) wisdom by way of own funds. in truth that almost all faculties wouldn't have time to educate a private funds a hundred and one direction. So what are modern scholars (and their mom and dad) to do? Peterson's do not cost a fortune comes to the rescue! it is a fresh, easy-to-comprehend consultant to aid scholars develop into financially savvy. Readers will locate such financially appropriate chapters as All approximately funds, Part-Time Jobs and how you can earn a living; studying Your Paycheck; Making experience Out of Banking; on-line Banking and invoice Paying; Saving for a wet Day; knowing Debt and credits; cost It! (Paying with Plastic); do not Spend all of it in a single position: Creating-and Sticking to-a price range; cash U: dealing with Your funds whereas in collage; making an investment; and the way to Make Your cash develop! inside of you are going to find:

Preview of Don't Break the Bank: A Student's Guide to Managing Money PDF

Similar Self Help books

inGenius: A Crash Course on Creativity

Innovative. cutting edge. inventive. those phrases describe the visionaries all of us recognize and recognize. they usually can describe you, too. opposite to universal trust, creativity isn't really a present a few of us are born with. it's a ability that every one people can study. foreign bestselling writer and award-winning Stanford collage educator Tina Seelig has labored with many of the company world’s most sensible and brightest, who're now one of the decision-makers at businesses resembling Google, Genentech, IBM, and Cisco.

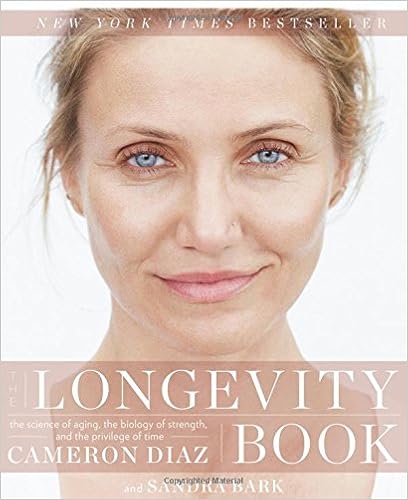

The Longevity Book: The Science of Aging, the Biology of Strength, and the Privilege of Time

Manhattan occasions bestsellerCameron Diaz follows up her number one big apple instances bestseller, The physique booklet, with a private, functional, and authoritative advisor that examines the artwork and technological know-how of growing old and provides concrete steps girls can take to create ample future health and resilience as they age. Cameron Diaz wrote The physique booklet to aid teach younger women approximately how their our bodies functionality, empowering them to make better-informed offerings approximately their wellbeing and fitness and inspiring them to appear past the most recent future health developments to appreciate their our bodies on the mobile point.

The Little Book of Skin Care: Korean Beauty Secrets for Healthy, Glowing Skin

The secrets and techniques at the back of the world's most lovely epidermis! In Korea, fit, gleaming epidermis is the precise kind of attractiveness. it is thought of plausible via all, women and men, younger and old—and it starts off with adopting a skin-first mentality. Now, this Korean attractiveness philosophy has taken the realm via hurricane! because the founding father of Soko Glam, a number one Korean attractiveness and way of life web site, esthetician and sweetness specialist Charlotte Cho courses you thru the world-renowned Korean ten-step skin-care routine—and a long way beyond—to assist you in achieving the clearest and so much radiant dermis of your lifestyles With Charlotte's step by step tutorials, skin-care advice, and recommendation on what to seem for in items in any respect cost degrees, you are going to find out how to pamper and take care of your epidermis at domestic with Korean-approved recommendations and pull off the "no make-up" make-up glance we have seen and widespread on ladies within the streets of Seoul.

TV’s most recent own finance celebrity exhibits tips on how to enhance the approach, self-discipline, and spirit to develop wealth by yourself terms—without worry or anxiousness, Farnoosh Torabi combines behavioral psychology with actual perspective! construct a more fit courting with money…map a plan according to what you care about…transform desires into reality.

Reviews

“ during this extraordinary ‘journey within,’ and with beauty, wit, and urban specificity, Farnoosh Torabi is helping participants concentrate on the mental and behavioral components which are serious to monetary and funding good fortune. ”

--David M. Darst, CFA, leader funding Strategist, Morgan Stanley Smith Barney and writer of The Little publication That Saves Your resources and The artwork of Asset Allocation

“Farnoosh rather will get it. Her insights are amazingly sensible, considerate, and complicated; a truly infrequent blend in terms of own finance specialists. Psych your self wealthy achieves a lofty objective: explaining a fancy challenge inside of sensible daily terms--without pulling any punches. Her suggestion is usually actionable, and her deep dedication to actually aiding youngsters via tricky monetary difficulties comes throughout loud and transparent. i'd like to see extra specialists stick with Farnoosh’s lead. ”

--Ian Cohen, CEO and President, credits. com

“As the situation shifts from the monetary to fiscal to social sphere, empowerment and know-how are the best allies of the person investor. Farnoosh paints an enlightened direction on our trip to higher tomorrows. ”

--Todd Harrison, FoTV’s most modern own finance superstar indicates the right way to strengthen the frame of mind, self-discipline, and spirit to develop wealth by yourself terms—without worry or nervousness, Farnoosh Torabi combines behavioral psychology with genuine perspective! construct a more healthy courting with money…map a plan according to what you care about…transform desires into truth.

- Chakra Frequencies: Tantra of Sound

- Chicken Soup for the Soul: Boost Your Brain Power! You Can Improve and Energize Your Brain at Any Age

- Gratitude Works!: A 21-Day Program for Creating Emotional Prosperity

- It's the Way You Say It: Becoming Articulate, Well-spoken, and Clear

- Sweet Poison Quit Plan

Additional resources for Don't Break the Bank: A Student's Guide to Managing Money

You will touch the credits bureau to do that. ) you want to take this chance to provide an explanation for any precise situations that will convey humans this used to be an strange occasion. for instance, if you happen to misplaced your activity or had scientific difficulties, you'll are looking to contain that details on your own assertion. If There Are mistakes on your file It within reason universal for credits stories to include mistakes. A lender or creditor can have mistakenly said your account as overdue, or your details can have gotten combined up with anyone else’s. (This occasionally occurs in case you have a typical identify. ) Of direction, there's additionally the prospect that the inaccurate info is the results of fraud or id robbery. in the event you see a list for an account you’ve by no means had or a lender you’ve by no means heard of, test contacting the corporate to determine what details it may well supply. for those who do spot error or in all likelihood fraudulent details, you might want to dossier a dispute with the credits bureau(s) right now. you are able to do this correct on their website. The credits bureau will touch the individual or company that supplied the data and ask for verification or facts of the placement. when you have been the sufferer of id robbery or fraud (or suspect you may have been), you could upload an alert to that truth in your credits experiences. it will enable humans understand that the data could be a results of fraudulent job, no longer your individual activities. you can even upload an alert that may require creditors to turn out your identification ahead of beginning an account or granting a mortgage on your identify. This prevents another individual from getting credits through posing as you. figuring out What to Pay First Okay, so let’s say you run right into a bit of a monetary dry spell, and also you are having difficulty paying your whole accounts. What for those who do? First, attempt calling you bank card businesses or different provider prone to work out in the event that they can give you any thoughts. occasionally, they could swap your money due date or figure out a fee plan that will help you come again on course. looking on the kind of account, they could also be capable of defer a money or . when you do this, should you nonetheless don’t come up with the money for to hide all your funds, it is very important make a decision which accounts get most sensible precedence. Any secured debt will be on the most sensible of the record. back, this can be a personal loan that’s secured through estate, reminiscent of a home or motor vehicle. while you're past due in this form of personal loan, the lender can repossess your vehicle or begin to foreclose in your apartment. subsequent, you want to pay bank card money owed. those are probably to file overdue funds to credits firms, which could damage your credits. software businesses are least prone to document overdue funds, so that you often have a few wiggle room with them. notwithstanding, remember that they might droop your provider in case your invoice is overdue, so that you must always touch them to attempt and manage a fee association to prevent that. development stable credits You don’t unexpectedly get strong credits in a single day. it could possibly take time to set up stable credits. (Remember, a element of your credit relies at the size of time you’ve had credits debts.