Retirement making plans is tough adequate with no need to deal with incorrect information. regrettably, a lot of the recommendation that's allotted is both unsubstantiated or betrays a powerful vested curiosity. In The crucial Retirement advisor, Frederick Vettese analyses the main primary questions of retirement making plans and gives a few startling insights. The booklet unearths, for instance that:

- Saving 10 percentage a 12 months isn't really a foul rule of thumb when you may possibly stick to it, yet there'll be occasions if you can't achieve this and it may no longer also be a good idea to try.

- Most humans by no means spend greater than 50 percentage in their gross source of revenue on themselves prior to retirement; accordingly their retirement source of revenue aim is mostly less than 70 percent.

- Interest charges will very likely remain low for the following twenty years, so one can have an effect on how a lot you must save.

- Even during this low-interest setting, you could withdraw five percentage or extra of your retirement discounts every year in retirement with out working out of money.

- Your spending in retirement will in all probability decline at a definite age so that you would possibly not have to store fairly up to you think.

- As humans achieve the later levels of retirement, they develop into much less in a position to coping with their funds, even if they develop extra convinced in their skill to take action! Plan for this ahead of it's too late.

- Annuities became very dear, yet they nonetheless make experience for a number of reasons.

In addition, The crucial Retirement Guide indicates how one can estimate your personal lifespan and allows you to comprehend the monetary implications of long term care. most significantly, it finds how one can calculate your individual wealth objective - the amount of cash you will want by the point you retire to reside with ease. the writer makes use of his actuarial services to confirm his findings yet does so in a jargon-free way.

Quick preview of The Essential Retirement Guide: A Contrarian's Perspective PDF

Similar Self Help books

inGenius: A Crash Course on Creativity

Imaginitive. cutting edge. creative. those phrases describe the visionaries all of us admire and recognize. they usually can describe you, too. opposite to universal trust, creativity isn't a present a few of us are born with. it's a ability that every one folks can study. foreign bestselling writer and award-winning Stanford college educator Tina Seelig has labored with the various enterprise world’s top and brightest, who're now one of the decision-makers at businesses comparable to Google, Genentech, IBM, and Cisco.

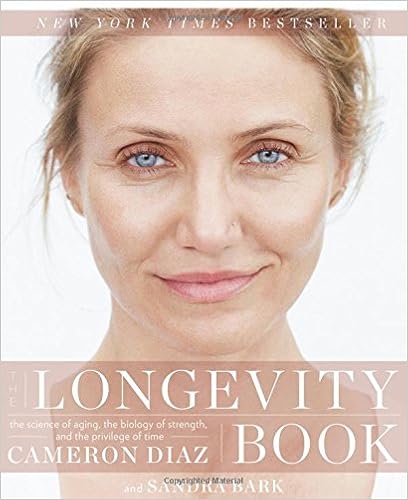

The Longevity Book: The Science of Aging, the Biology of Strength, and the Privilege of Time

Long island occasions bestsellerCameron Diaz follows up her number 1 manhattan occasions bestseller, The physique publication, with a private, functional, and authoritative advisor that examines the artwork and technological know-how of getting old and gives concrete steps ladies can take to create considerable overall healthiness and resilience as they age. Cameron Diaz wrote The physique publication to assist teach younger ladies approximately how their our bodies functionality, empowering them to make better-informed offerings approximately their future health and inspiring them to appear past the newest health and wellbeing developments to appreciate their our bodies on the mobile point.

The Little Book of Skin Care: Korean Beauty Secrets for Healthy, Glowing Skin

The secrets and techniques in the back of the world's most lovely pores and skin! In Korea, fit, sparkling pores and skin is the perfect type of attractiveness. it is thought of attainable via all, women and men, younger and old—and it starts with adopting a skin-first mentality. Now, this Korean good looks philosophy has taken the realm through hurricane! because the founding father of Soko Glam, a number one Korean attractiveness and way of life web site, esthetician and wonder professional Charlotte Cho courses you thru the world-renowned Korean ten-step skin-care routine—and some distance beyond—to assist you in attaining the clearest and so much radiant pores and skin of your existence With Charlotte's step by step tutorials, skin-care information, and suggestion on what to seem for in items in any respect fee degrees, you are going to pamper and take care of your epidermis at domestic with Korean-approved ideas and pull off the "no make-up" make-up glance we have seen and well-liked on girls within the streets of Seoul.

TV’s most recent own finance megastar exhibits tips on how to increase the attitude, self-discipline, and spirit to develop wealth by yourself terms—without worry or nervousness, Farnoosh Torabi combines behavioral psychology with genuine angle! construct a more fit courting with money…map a plan in response to what you care about…transform goals into reality.

Reviews

“ during this incredible ‘journey within,’ and with attractiveness, wit, and urban specificity, Farnoosh Torabi is helping contributors concentrate on the mental and behavioral parts which are severe to monetary and funding luck. ”

--David M. Darst, CFA, leader funding Strategist, Morgan Stanley Smith Barney and writer of The Little e-book That Saves Your resources and The artwork of Asset Allocation

“Farnoosh quite will get it. Her insights are amazingly sensible, considerate, and complicated; a really infrequent mixture by way of own finance specialists. Psych your self wealthy achieves a lofty objective: explaining a fancy challenge inside sensible daily terms--without pulling any punches. Her recommendation is usually actionable, and her deep dedication to truly aiding kids via difficult monetary difficulties comes throughout loud and transparent. i might like to see extra specialists stick with Farnoosh’s lead. ”

--Ian Cohen, CEO and President, credits. com

“As the concern shifts from the monetary to monetary to social sphere, empowerment and understanding are the best allies of the person investor. Farnoosh paints an enlightened course on our trip to higher tomorrows. ”

--Todd Harrison, FoTV’s most up-to-date own finance famous person exhibits the way to boost the mind-set, self-discipline, and spirit to develop wealth by yourself terms—without worry or nervousness, Farnoosh Torabi combines behavioral psychology with genuine perspective! construct a more healthy courting with money…map a plan in keeping with what you care about…transform goals into truth.

- Resilience: Hard-Won Wisdom for Living a Better Life

- How to be a Pickup Artist

- 13 Things Mentally Strong People Don't Do: Take Back Your Power, Embrace Change, Face Your Fears, and Train Your Brain for Happiness and Success

- Riding the Rocket: How to Manage Your Modern Career

- How to Like Yourself: A Teen's Guide to Quieting Your Inner Critic and Building Lasting Self-Esteem

Additional info for The Essential Retirement Guide: A Contrarian's Perspective

Within the perfect scenario, the four percentage rule is meant to complete 3 pursuits: offer a retirement source of revenue move that grows over the years to maintain speed with inflation. let you keep keep an eye on of your funds in case of an emergency. depart a considerable bequest to household. The implicit assumption is that your portfolio will generate a excessive adequate genuine go back (close to four percentage) to accomplish those 3 pursuits. desk 17. 1 provides a demonstration of the rule of thumb in motion, utilizing an preliminary account stability of $500,000 and a true go back at the portfolio of four percentage. I simplified the mathematics through assuming withdrawals are made yearly, at year-end. desk 17. 1 How the four percentage Rule Works yr Account stability Withdrawal of four% at finish of 12 months funding go back 1 $500,000 $20,000 $30,000 2 $510,000 $20,400 $30,600 three $520,200 $20,808 $31,212 four $530,604 $21,224 $31,836 suppose inflation is two% and genuine go back is four% As desk 17. 1 indicates, the four percentage withdrawals develop each year in line with inflation, yet due to a true funding go back of four percentage, so does the account stability. This feels like a tidy association in concept. allow us to see the way it might have labored in genuine lifestyles. determine 17. 1 indicates the source of revenue retiree can have withdrawn less than the four percentage rule from 1988 to 2012, with a beginning stability of $200,000. it truly is assumed that the account stability used to be invested 50 percentage in equities and 50 percentage in bonds the full time and that annual funding administration charges have been 1 percentage of resources. determine 17. 1 historic source of revenue from four percentage Rule If whatever, the chart turns out to substantiate that the four percentage rule works admirably in perform. The preliminary source of revenue of approximately $8,000 nearly triples in nominal phrases and in addition rises considerably in genuine phrases (with a number of hiccups among 2000 and 2009 in the course of the endure markets). What could be improper with this? issues of the four percentage Rule The four percentage rule comprises at the least 4 significant flaws, notwithstanding the 1st flaws, as defined subsequent, no less than offset one another to a point. Unrealistic Returns The four percentage rule is contingent on attaining a true go back of with reference to four percentage each year. As determine 17. 1 confirmed, a market-based portfolio simply did that and extra long ago 25 or so years. within the Nineties, even a monotonous portfolio of super-safe govt bonds could have added genuine returns within the region of four percentage. As we realized in bankruptcy 6, in spite of the fact that, the capital markets are usually not what they was. during this period of low rates of interest, a four percentage actual go back will be a stretch, even in a professionally controlled portfolio. you may be doing good to earn a bit greater than three percentage, or even then you definitely might want to think a few hazard to take action. a part of the matter is that we won't count on as excessive of a go back from fairness investments as we used to. Equities have performed an admirable task in generating excessive returns over the longer term, assuming one averages returns over lengthy sufficient sessions to delicate out the volatility. desk 17. 2 exhibits the true returns on Canadian equities in each one 10-year interval considering that 1934 (US equities might have played equally well).