By Dave Ramsey

This quickly and easy, query and resolution booklet is the proper source for equipping people with key information regarding daily cash issues. Questions and solutions take care of a hundred+ of the most–asked questions from The Dave Ramsey Show–everything from price range making plans to retirement making plans or own paying for concerns, to saving for faculty and charitable giving. this can be Dave in his most well-liked format–ask a selected query, get a particular solution.

Quick preview of The Money Answer Book: Quick Answers to Everyday Financial Questions PDF

Best Self Help books

inGenius: A Crash Course on Creativity

Creative. leading edge. creative. those phrases describe the visionaries all of us admire and respect. and so they can describe you, too. opposite to universal trust, creativity isn't a present a few of us are born with. it's a ability that every one people can study. foreign bestselling writer and award-winning Stanford collage educator Tina Seelig has labored with the various enterprise world’s most sensible and brightest, who're now one of the decision-makers at businesses reminiscent of Google, Genentech, IBM, and Cisco.

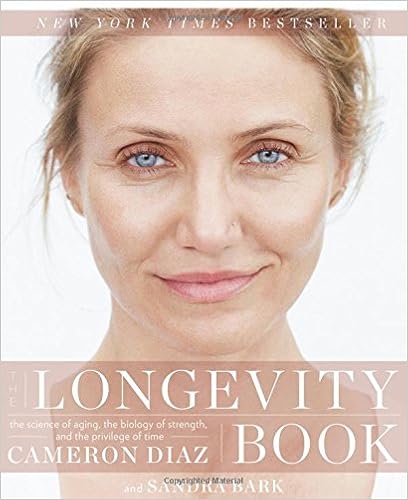

The Longevity Book: The Science of Aging, the Biology of Strength, and the Privilege of Time

Ny instances bestsellerCameron Diaz follows up her number 1 big apple occasions bestseller, The physique publication, with a private, functional, and authoritative advisor that examines the paintings and technology of getting older and gives concrete steps girls can take to create considerable future health and resilience as they age. Cameron Diaz wrote The physique booklet to assist teach younger ladies approximately how their our bodies functionality, empowering them to make better-informed offerings approximately their well-being and inspiring them to seem past the most recent overall healthiness traits to appreciate their our bodies on the mobile point.

The Little Book of Skin Care: Korean Beauty Secrets for Healthy, Glowing Skin

The secrets and techniques in the back of the world's most lovely pores and skin! In Korea, fit, gleaming dermis is the perfect type of attractiveness. it really is thought of achieveable via all, women and men, younger and old—and it starts off with adopting a skin-first mentality. Now, this Korean attractiveness philosophy has taken the realm by means of hurricane! because the founding father of Soko Glam, a number one Korean good looks and way of life web site, esthetician and sweetness professional Charlotte Cho courses you thru the world-renowned Korean ten-step skin-care routine—and a long way beyond—to assist you in achieving the clearest and so much radiant pores and skin of your lifestyles With Charlotte's step by step tutorials, skin-care information, and recommendation on what to seem for in items in any respect cost degrees, you will easy methods to pamper and deal with your pores and skin at domestic with Korean-approved innovations and pull off the "no make-up" make-up glance we have seen and popular on ladies within the streets of Seoul.

TV’s most up-to-date own finance superstar exhibits tips on how to strengthen the frame of mind, self-discipline, and spirit to develop wealth by yourself terms—without worry or anxiousness, Farnoosh Torabi combines behavioral psychology with genuine angle! construct a more healthy dating with money…map a plan in line with what you care about…transform desires into reality.

Reviews

“ during this superb ‘journey within,’ and with beauty, wit, and urban specificity, Farnoosh Torabi is helping members specialize in the mental and behavioral components which are severe to monetary and funding luck. ”

--David M. Darst, CFA, leader funding Strategist, Morgan Stanley Smith Barney and writer of The Little publication That Saves Your resources and The paintings of Asset Allocation

“Farnoosh quite will get it. Her insights are amazingly sensible, considerate, and complex; a truly infrequent mix by way of own finance specialists. Psych your self wealthy achieves a lofty target: explaining a posh challenge inside of sensible daily terms--without pulling any punches. Her suggestion is often actionable, and her deep dedication to actually assisting children via difficult monetary difficulties comes throughout loud and transparent. i'd like to see extra specialists stick with Farnoosh’s lead. ”

--Ian Cohen, CEO and President, credits. com

“As the predicament shifts from the monetary to fiscal to social sphere, empowerment and wisdom are the best allies of the person investor. Farnoosh paints an enlightened direction on our trip to raised tomorrows. ”

--Todd Harrison, FoTV’s most up-to-date own finance celebrity indicates tips to increase the frame of mind, self-discipline, and spirit to develop wealth by yourself terms—without worry or anxiousness, Farnoosh Torabi combines behavioral psychology with genuine perspective! construct a more healthy dating with money…map a plan in response to what you care about…transform desires into truth.

- The Biology of Beating Stress: How Changing Your Environment, Your Body, and Your Brain Can Help You Find Balance and Peace

- How To Eat An Elephant: One Day A Month To Financial Success

- Mastery

- It's the Way You Say It: Becoming Articulate, Well-spoken, and Clear

- No Excuses!: The Power of Self-Discipline

Additional resources for The Money Answer Book: Quick Answers to Everyday Financial Questions

The Bible says, “The borrower is servant to the lender. ” (Proverbs 22:7 niv) If you’re in debt then you’re a slave; you don't have the liberty to exploit your cash to powerfully switch your loved ones tree. Debt is common! So why be common? do you need to be like 70 percentage of all families that dwell paycheck to paycheck? It takes loads of will, self-discipline, and braveness to slay the debt monster. however it should be performed. Think—how a lot may you set towards retirement when you didn’t have a motor vehicle fee? the idea that of credits itself is “new” to the private finance scene. What? certain, that’s correct. the belief of utilizing credits as an important point of one’s own financial statement is below fifty years outdated. After the Fifties, credits grew to become a advertising software for firms that desired to persuade shoppers to shop for even 15 00-01. DRMAB. indd 15 11/6/13 10:53 AM The cash resolution booklet reasonable goods on credits. The message of credits is, “Enjoy now and pay for it later. ” the common family will get six new bank card deals each month, and the typical collage scholar will get one new supply each few days! a few everyone is extra protecting in their credit standing than of the other factor, whilst credits is the monster that’s destroying their destiny and sending them down the line to financial ruin. Even the sound of that notice sends chills up the backbone. but when you’re dealing with the possibility of financial disaster, or if you’re in the midst of it immediately, it’s a dwelling nightmare. It’s frightening. it might probably devastate your task and your marriage. the very first thing you want to be aware of is so you might make it. i used to be there individually at age twenty-four. I misplaced all of it. i do know the disgrace, the discomfort, the damage, the phobia, and all of the different feelings that include financial disaster. There quite is wish. while you are contemplating financial ruin you furthermore may want to know that i like to recommend financial disaster approximately as frequently as i like to recommend divorce—almost by no means! there are alternatives most folks have by no means tested which could really hinder financial disaster. Debt is dumb, and credits destroys. yet you don’t need to fall into the traps. Welcome to the genuine global! sixteen 00-01. DRMAB. indd sixteen 11/6/13 10:53 AM D e bt , C r e d i t & B a n okay r u p t c y How do I get the ball rolling to get out of debt ? We’ve built a bit technique referred to as the newborn Steps to do something at a time and continue it uncomplicated. the primary is to prevent every thing other than minimal funds, and concentrate on something at a time. another way not anything will get complete simply because your entire attempt is diluted. First collect $1,000 money as an emergency fund. Then commence intensely casting off all debt (except the home) utilizing the debt snowball. You assault the smallest debt first, nonetheless holding minimal funds on every little thing else. Do what's essential to concentration your cognizance. maintain stepping as much as the following greatest invoice. After the credits debt is treated, paintings to construct the emergency fund as much as 3 to 6 months of bills. Now begin placing 15 percentage of your source of revenue into retirement money. Then retailer on your childrens’ collage expenditures, after which visit paintings on paying off the home.