By Paul Sullivan

The “Wealth Matters” columnist of The big apple Times unearths the conduct, worldviews, and practices that bring about precise wealth—and why it’s extra very important to be “wealthy” than “rich.”

For the higher a part of the earlier decade, Paul Sullivan has written approximately and lived between a number of the wealthiest humans in the US. He has realized how they retailer, spend, and make investments their funds; how they paintings and relaxation; how they use their wealth to provide their young children academic benefits yet no longer strip them of motivation. He has additionally visible how they make horrendous blunders. Firsthand, Sullivan is familiar with why a few humans, even “rich” humans, by no means locate precise wealth, and why people, even those that have a long way much less are a lot wealthier.

Sullivan is a part of the “The One Percent” at the present time, yet he got here from some distance humbler roots, beginning lifestyles within the backside twenty-five percentage. This own e-book exhibits how others could make higher monetary decisions—and come to phrases with what cash ability to them. It lays out how they could steer clear of the pitfalls round saving, spending and giving their funds away and imagine another way approximately wealth to guide safer and not more demanding lives. an important supplement to the entire monetary suggestion on hand, this special advisor is a welcome antidote to the concept that wealth is a bunch on a financial institution assertion.

Quick preview of The Thin Green Line: How I Learned the Difference Between Being Wealthy and Rich and Why It Matters to Everyone PDF

Best Self Help books

inGenius: A Crash Course on Creativity

Resourceful. leading edge. inventive. those phrases describe the visionaries all of us appreciate and respect. they usually can describe you, too. opposite to universal trust, creativity isn't a present a few of us are born with. it's a ability that every one folks can study. overseas bestselling writer and award-winning Stanford college educator Tina Seelig has labored with the various enterprise world’s most sensible and brightest, who're now one of the decision-makers at businesses akin to Google, Genentech, IBM, and Cisco.

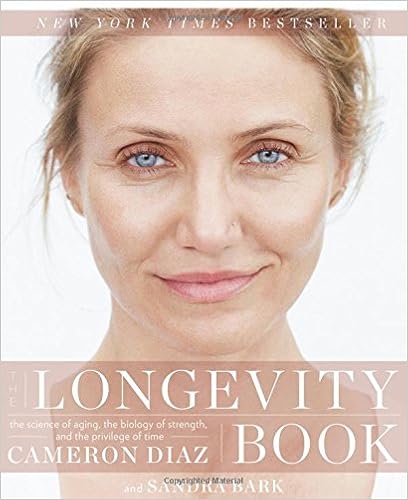

The Longevity Book: The Science of Aging, the Biology of Strength, and the Privilege of Time

Ny occasions bestsellerCameron Diaz follows up her no 1 ny occasions bestseller, The physique booklet, with a private, sensible, and authoritative consultant that examines the paintings and technology of getting older and gives concrete steps ladies can take to create ample wellbeing and fitness and resilience as they age. Cameron Diaz wrote The physique e-book to assist train younger ladies approximately how their our bodies functionality, empowering them to make better-informed offerings approximately their health and wellbeing and inspiring them to seem past the most recent healthiness traits to appreciate their our bodies on the mobile point.

The Little Book of Skin Care: Korean Beauty Secrets for Healthy, Glowing Skin

The secrets and techniques at the back of the world's most pretty epidermis! In Korea, fit, sparkling pores and skin is the right type of good looks. it really is thought of conceivable through all, women and men, younger and old—and it starts off with adopting a skin-first mentality. Now, this Korean good looks philosophy has taken the realm by means of typhoon! because the founding father of Soko Glam, a number one Korean attractiveness and way of life site, esthetician and sweetness professional Charlotte Cho courses you thru the world-renowned Korean ten-step skin-care routine—and some distance beyond—to assist you in attaining the clearest and so much radiant epidermis of your lifestyles With Charlotte's step by step tutorials, skin-care suggestions, and suggestion on what to seem for in items in any respect cost degrees, you are going to how to pamper and take care of your pores and skin at domestic with Korean-approved innovations and pull off the "no make-up" make-up glance we have seen and in demand on ladies within the streets of Seoul.

TV’s latest own finance famous person indicates how you can enhance the mind-set, self-discipline, and spirit to develop wealth by yourself terms—without worry or nervousness, Farnoosh Torabi combines behavioral psychology with actual angle! construct a more fit dating with money…map a plan in keeping with what you care about…transform goals into reality.

Reviews

“ during this really good ‘journey within,’ and with attractiveness, wit, and urban specificity, Farnoosh Torabi is helping participants specialise in the mental and behavioral components which are serious to monetary and funding good fortune. ”

--David M. Darst, CFA, leader funding Strategist, Morgan Stanley Smith Barney and writer of The Little ebook That Saves Your resources and The artwork of Asset Allocation

“Farnoosh quite will get it. Her insights are amazingly sensible, considerate, and complicated; a truly infrequent mixture by way of own finance specialists. Psych your self wealthy achieves a lofty aim: explaining a fancy challenge inside of sensible daily terms--without pulling any punches. Her recommendation is usually actionable, and her deep dedication to truly supporting teens via difficult monetary difficulties comes throughout loud and transparent. i'd like to see extra specialists keep on with Farnoosh’s lead. ”

--Ian Cohen, CEO and President, credits. com

“As the predicament shifts from the monetary to monetary to social sphere, empowerment and expertise are the best allies of the person investor. Farnoosh paints an enlightened direction on our trip to raised tomorrows. ”

--Todd Harrison, FoTV’s most up-to-date own finance big name indicates tips to enhance the attitude, self-discipline, and spirit to develop wealth by yourself terms—without worry or nervousness, Farnoosh Torabi combines behavioral psychology with actual angle! construct a more healthy dating with money…map a plan in response to what you care about…transform goals into fact.

- Creating a Life Worth Living

- The Game of Life and How to Play It

- Get Lucky: How to Put Planned Serendipity to Work for You and Your Business

- The Mandala of Being: Discovering the Power of Awareness

- Smart Calling: Eliminate the Fear, Failure, and Rejection From Cold Calling

- Law of Connection: The Science of Using NLP to Create Ideal Personal and Professional Relationships

Extra resources for The Thin Green Line: How I Learned the Difference Between Being Wealthy and Rich and Why It Matters to Everyone

A savvier investor might take that info and judge what he notion the price of a inventory could be and purchase or promote it hence. whereas he wouldn't panic since it went down one day—he may well purchase extra as the lower cost made it a deal—he could, simply as importantly, promote the inventory while it reached the worth he notion it's going to have. lamentably, the common investor performing on his personal doesn't have this sort of persistence. The Maymin-Fisher examine, which used to be released within the magazine of Wealth administration in 2011, stumbled on that the type of knee-jerk reactions to what occurred the day ahead of fee an investor four percent issues of go back every year. That’s not just a drag at the portfolio yet is hard to get over over the years. What’s extra, there no logical explanation for humans to name once they did. “It’s extra concerning the randomness of what they ate for lunch yesterday,” Fisher acknowledged. “Or in the event that they obtained Google on the IPO, they’re likely to are looking to purchase fb. That explains their hazard habit extra. ” and folks with more cash referred to as with an identical frequency as individuals with much less. The examine argued that the yearly loss humans suffered from their very own folly used to be more than the 1 percentage an adviser charged to control their cash. that may sound like a controversy for utilizing an adviser, however the end result presumed that advisers might carry themselves above an identical urges that affected their consumers. Don Phillips, president of funding examine at Morningstar, which screens mutual-fund functionality, has puzzled no matter if advisers can hold consumers from making undesirable judgements. “If so much traders use advisers and such a lot traders proceed to do the incorrect factor, then there has to be a major volume of undesirable suggestion being given,” Phillips wrote in a Morningstar file in October 2010. This was once an issue for uninteresting index cash that will be rebalanced with none enter from the investors—a rational alternative that will aid placed you at the correct aspect of the skinny eco-friendly line, yet person who so much traders fight with simply because they suspect they could decide winners. What i discovered both attention-grabbing within the Maymin-Fisher examine was once the learn that supplied its speculation: a 1978 mental examine of a guy who couldn't keep watch over his urges to binge-eat in the midst of the evening. He went as far as to place a lock on his fridge and provides the most important to a chum. yet he nonetheless awakened desirous to devour, not able to regulate the urge on his personal. at some point soon the fridge wouldn't be locked and he could binge back. Maymin made an analogous commentary approximately Fisher’s clients—and traders usually: a few can't support themselves in purchasing excessive and promoting low. “The urge by no means is going to zero,” he acknowledged. “People who are looking to alternate aggressively, it is going to by no means leave. If the industry is risky, it raises. ” a normal investor may be at an advantage contemplating that fridge, that urge to exchange, as one among Thaler’s fictional buckets known as “retirement” or “college discounts” or “winter holiday. ” He may possibly mentally lock his cash there and never contact it.